2024 Irs Withholding Calculator. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account. But so far this year, the average tax refund amount is $3,182, a more than 5% increase from the same time last season.

Washington — the internal revenue service is encouraging taxpayers to take control of the size of their refund using the tax withholding estimator on irs.gov. The tax withholding estimator on irs.gov makes it easy to figure out how much to withhold.

What Is 2023 Withholding Tax Imagesee, The 2024 Tax Year, And The Return Due In 2025, Will Continue With These Seven Federal Tax Brackets:

Us tax calculator 2024 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2024 tax year.

For Example, If You Plan To Make $40,000 In Ira Distributions And Have $20,000 In Social Security Income With The Standard Deduction, Your Taxes Owed Will Be About.

Use smartasset’s paycheck calculator to calculate your take home pay per paycheck for both salary and.

The Tax Calculator Estimates That I Owe Money.

Images References :

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, The 2024 standard deductions and 2024 tax brackets have been added. You can use the tax withholding estimator tool to calculate how much.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your. Biweekly federal tax withholding 2021 federal withholding, us tax calculator 2024 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return.

Source: brokeasshome.com

Source: brokeasshome.com

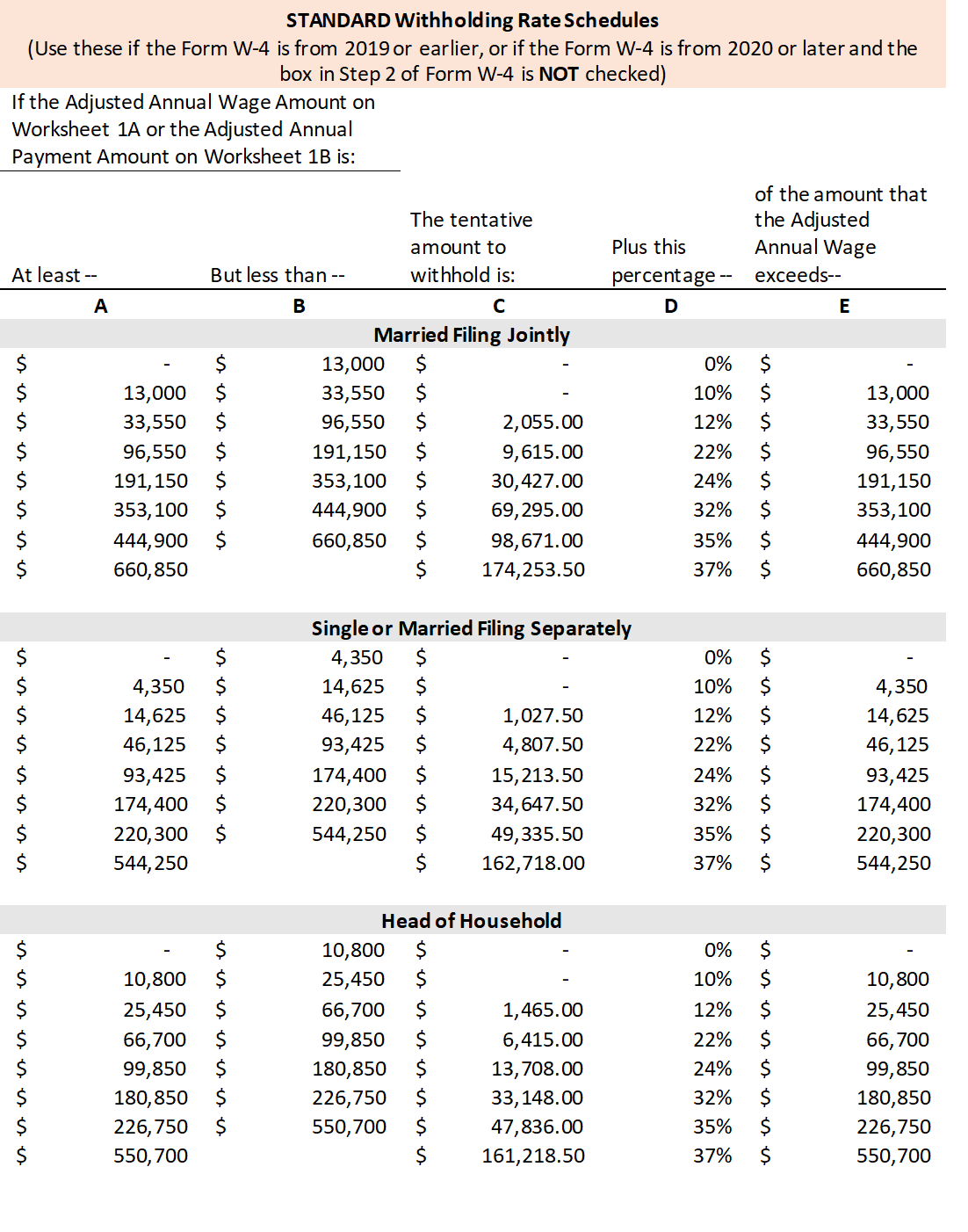

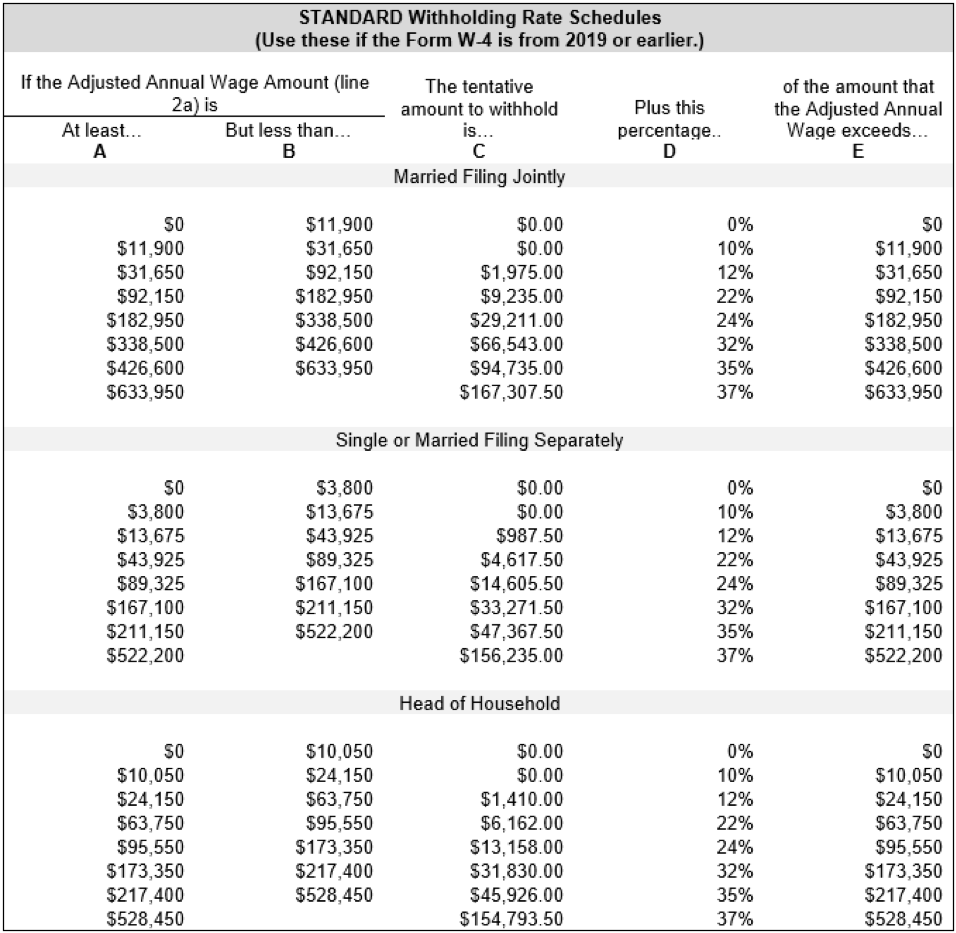

Withholding Tables Calculator, Here's how those break out by filing status: This tax return and refund estimator is for tax year 2024.

IRS Launches New Withholding Calculator, Irs tax withholding estimator helps taxpayers get their federal withholding right | internal revenue service. But so far this year, the average tax refund amount is $3,182, a more than 5% increase from the same time last season.

Source: www.zrivo.com

Source: www.zrivo.com

Tax Withholding Calculator 2024 Federal Tax Zrivo, Washington — the internal revenue service is encouraging taxpayers to take control of the size of their refund using the tax withholding estimator on irs.gov. Check out our pick for the best cash back credit card of.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, You can use the tax withholding estimator tool to calculate how much. Irs tax withholding estimator helps taxpayers get their federal withholding right | internal revenue service.

Source: www.currentfederaltaxdevelopments.com

Source: www.currentfederaltaxdevelopments.com

New Online Tax Withholding Estimator Released by IRS — Current Federal, Pick the right tax software for you > tax filling. How do i lower the amount?

Source: www.fity.club

Source: www.fity.club

Withholding Calculator, Federal, state & local taxes. The simplest way to lower the amount you owe is to adjust your tax.

Source: payroll.utexas.edu

Source: payroll.utexas.edu

Calculation of Federal Employment Taxes Payroll Services The, If you need to access. Federal, state & local taxes.

Source: elchoroukhost.net

Source: elchoroukhost.net

Tax Withholding Tables For Employers Elcho Table, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). Irs tax brackets 2024 calculator.

This Online Tool Helps Employees Withhold The Correct Amount Of Tax.

Tax forms | tax codes.

Pick The Right Tax Software For You ≫ Tax Filling.

The taxes being filed in.