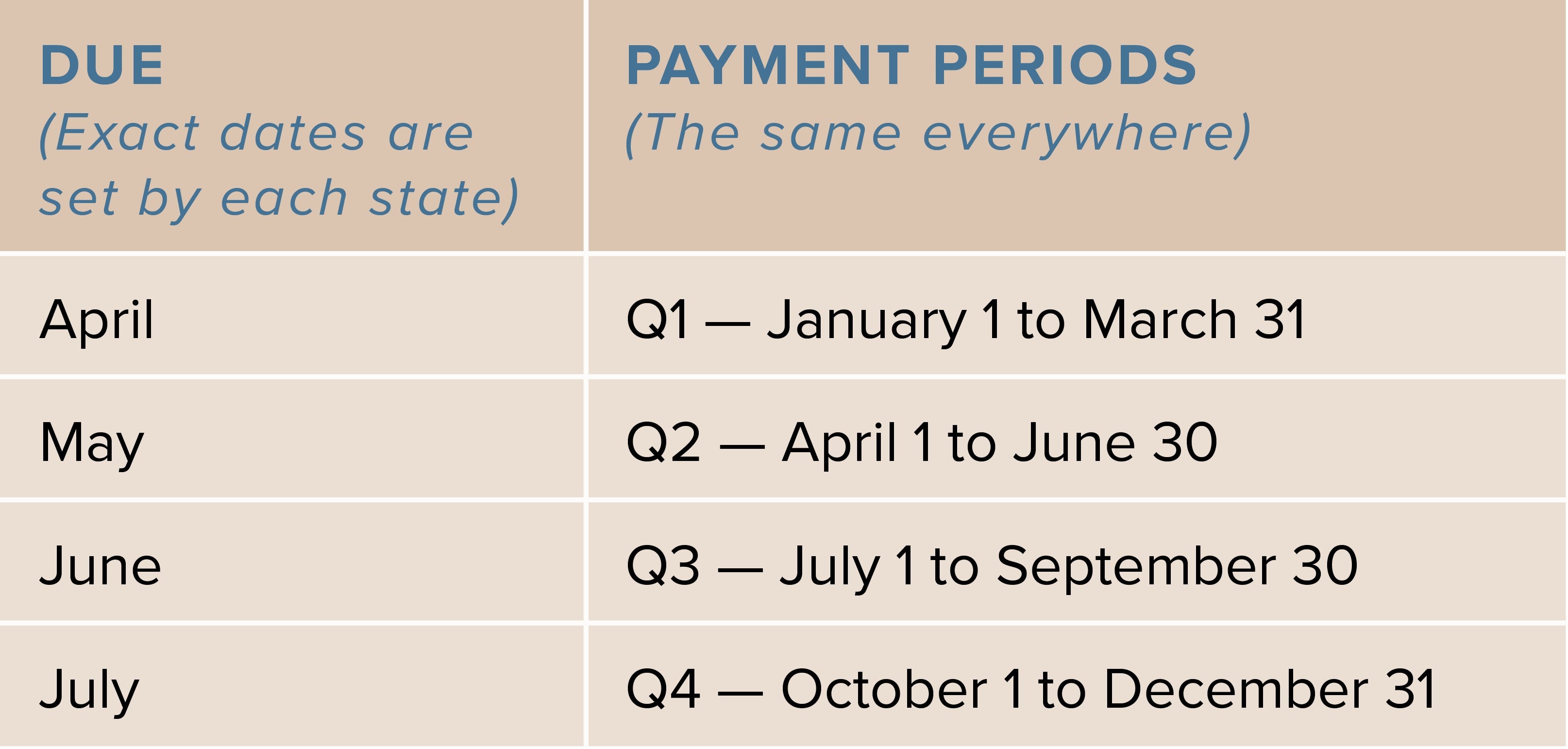

Estimated Tax Payments 2024 Safe Harbor Rule. To avoid the underpayment penalty, you must make estimated tax payments by the due dates of each quarter. Not paying enough tax for the year;

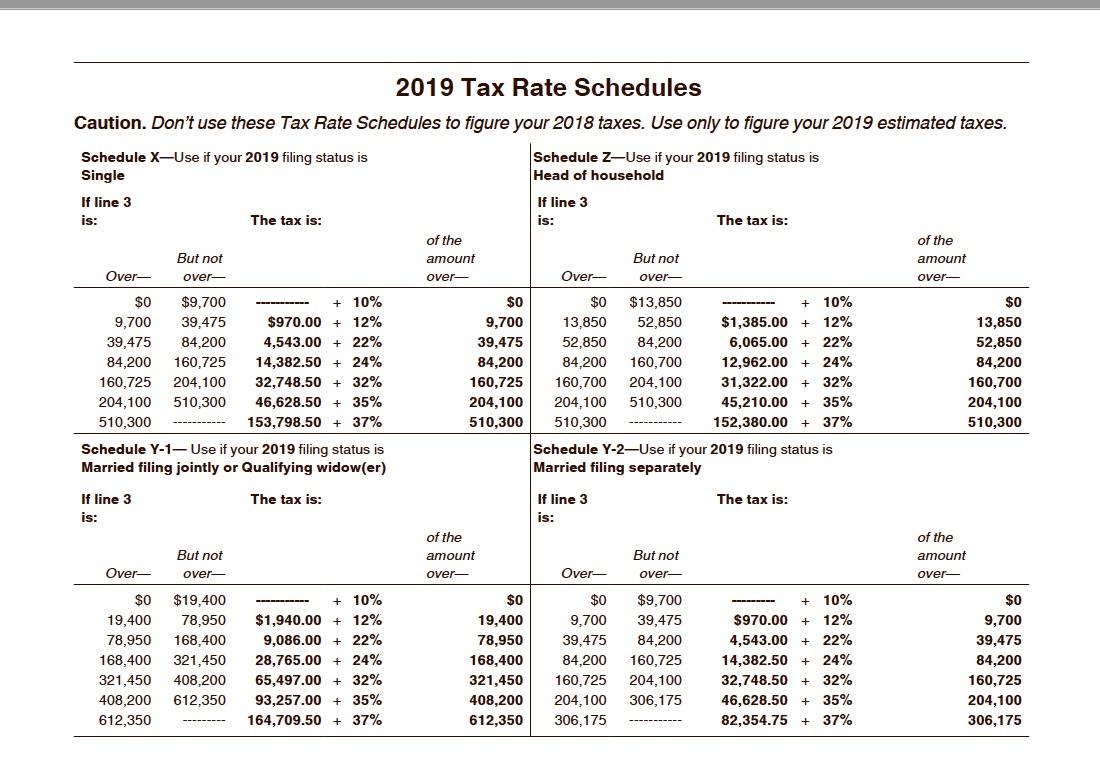

If at filing time, you have not paid enough income taxes through withholding or quarterly estimated payments, you may have to pay a penalty for underpayment. Estimated tax is the tax you expect to owe for the current tax year after subtracting:

Estimated Tax Payments 2024 Safe Harbor Rule Images References :

Source: wallethacks.com

Source: wallethacks.com

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2024), In general, a “safe harbor” is a provision that protects from penalties when certain conditions are met.

Source: www.youtube.com

Source: www.youtube.com

Safe Harbor and Estimated Tax Payments YouTube, The irs may impose penalties on quarterly tax payments for a few reasons:

Source: cheridawgail.pages.dev

Source: cheridawgail.pages.dev

Safe Harbor Estimated Tax Payments 2024 Kacy Sallie, For an individual to calculate their estimated tax payments they must estimate their expected taxable income, factoring in deductions and credits to properly calculate the estimated tax for the year.

Source: www.youtube.com

Source: www.youtube.com

091 Using The Safe Harbor Method for Quarterly Estimated Tax Payments, The safe harbor rule is a provision in the tax code that aims to simplify estimated tax payments for individuals and businesses.

Source: corieylorianna.pages.dev

Source: corieylorianna.pages.dev

How To Calculate 2024 Estimated Tax Payments Corine Patricia, Paying 100% of the taxes you owed on last year’s federal tax return is sometimes referred to as the safe harbor rule.

Source: www.harpercpaplus.com

Source: www.harpercpaplus.com

What is the safe harbor, and what does it mean for estimated tax, In the case of underpayment penalties, the safe harbor rule allows you to avoid a penalty if you pay 90% of the tax you owe in the current year or if you pay 100% of last year’s tax liability.

Source: lornaykristine.pages.dev

Source: lornaykristine.pages.dev

Estimated Tax Payments 2024 Dates And Amounts Sibyl Pammie, What is the safe harbor for estimated tax payments?

Source: www.youtube.com

Source: www.youtube.com

What is the safe harbor rule for estimated tax payments in NY? YouTube, The safe harbor rule is a provision in the tax code that aims to simplify estimated tax payments for individuals and businesses.

Source: vallyyhyacinthe.pages.dev

Source: vallyyhyacinthe.pages.dev

Irs Estimated Tax Payments 2024 Worksheet Anny Sherri, Luckily, if you miss a payment, you may still be able to avoid the penalty if you make up the payment by the following quarter.

Source: dorolicewellen.pages.dev

Source: dorolicewellen.pages.dev

What Is The Safe Harbor Rule For Taxes In 2024 Rhona Cherrita, Estimated tax payment safe harbor details.

Posted in 2024